Market Bubbles: When Hype Inflates and Reality Pops

Intro

Market Bubbles. A pretty intimidating and scary economic phenomenon that is masked by possible ignorance and excitement. In this edition of Market Insider, we will discuss what Market Bubbles are and how you can protect yourself against potential losses.

What is a Market Bubble?

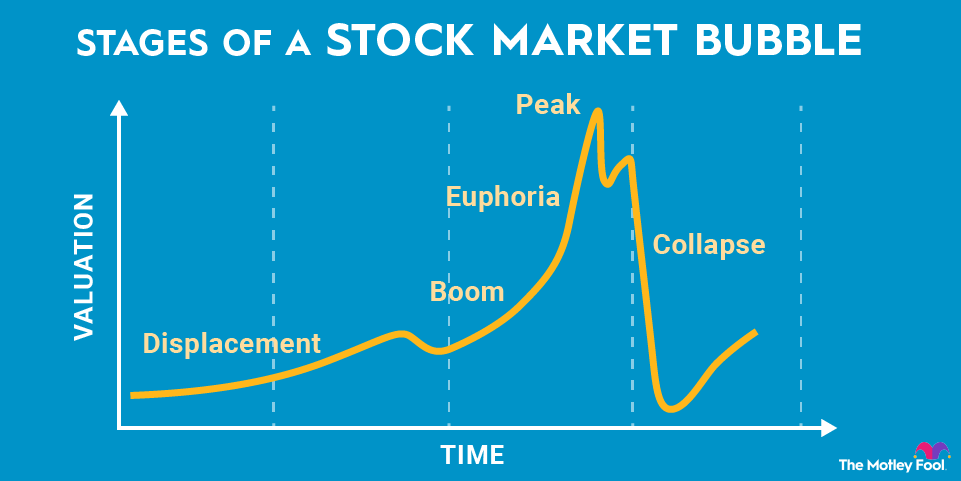

Market Bubbles are periods of time when asset prices rise to an unsustainable level, fueled by speculative trading and euphoria in a specific industry or sector, which eventually leads to a "pop" or a crash when the euphoria subsides. What starts as an "undervalued" sector that grabs investors' attention turns into an over-bloated behemoth of an industry whose foundation was built with euphoria and irrationality. When investors discover said industry and deem it "undervalued," investors pile in (large institutional and private investors alike), growing the sector seemingly exponentially, backed not by profit or demand for products (actual value of assets) but by an expectation in the future price of the stock(the boom). However, at this stage, some begin to realize the overvaluation of stocks, and begin to sell there positions to net profit,signalingl to the rest of the market that a downturn is coming. Then, the market's excitement in the sector dies down, and investors begin to panic sell, which drives down the market substantially and the industry as well.

Historical Examples of Market Bubbles

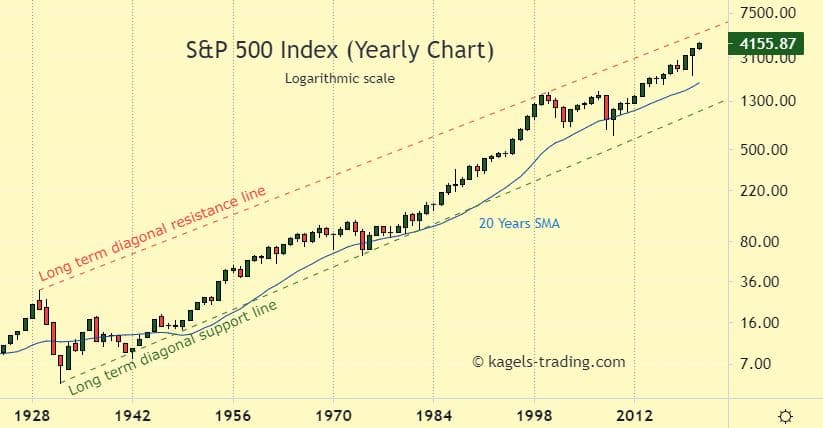

To fully understand Market Bubbles, it is essential to examine some key historical examples. We will focus on two examples here, the Dot-Com bubble of 1999-2000 and the Housing bubble of 2008. To begin, the Dot Com bubble started to develop in the mid-1990s with the commercialization of the internet and the launch of Netscape, setting a precedent for high valuations of tech companies throughout the market. Stocks began to grow exponentially based on speculative hopes among investors, with the NASDAQ increasing by a factor of five between 1995 and 2000. By March of 2000, though, investor euphoria was running dry, and since many tech and internet companies' valuations did not reflect the actual asset value of the company, the market crashed. Stocks such as Yahoo Finance (which went from over $100 to $4 in about 2 years) collapsed as investors rushed to panic-sell to net a profit before the market crashed on top of them.

Now, the 2008 housing bubble. Starting in the early 2000s, lending standards for loans were loosened, which enabled the issuance of subprime mortgages in significant quantities (subprime mortgages are home loans for borrowers with poor credit histories). For these subprime mortgages, banks offered poor credit borrowers adjustable rates that would typically start low and then increase after a couple of years to an almost unaffordable level for homeowners. During this time, banks who sold these subprime mortgages practiced securitization, grouping these mortgages into financial products called mortgage-backed securities (MBS). These securities masked the risk associated with subprime mortgages, with many rating agencies such as Moody's giving the securities high safety ratings. However, the risk began to seem apparent when the rapid growth of the housing market slowed, and home prices started to fall. Many of the adjustable rates on subprime mortgages revealed their "new," higher rates, which borrowers could not afford. This led to many borrowers defaulting on their payments and experiencing foreclosures as the value of MBS plummeted, causing banks to suffer significant losses as well. Banks such as Lehman Brothers and Bear Stearns went under, which dragged down markets. With the freezing of credit markets in the US, the global recession spread to markets around the world.

A common theme of both of these market bubbles is the phenomenon of euphoria in a sector of the market, and the significant over-speculation fueled by the euphoria. With all this sentiment building up in markets, stock prices are driven up, and then euphoria gives way, leading to a market crash and an economic recession. However, it is worth noting that markets have bounced back from these notable economic downturns to a great extent. For example, after the Dot-Com bubble, even though markets took around ten years to recover, the eventual adoption of the internet, along with tangible innovation in the tech industry, led to a recovery. Today, the tech industry is one of the richest and most profitable in the world for investors. As for the Housing market, prices began to recover after about 5 to 6 years, fueled by government bailouts, Fed stimulus, and enhanced regulatory measures being passed. The housing market is a growing industry, with demand significantly higher than it was after the 2008 collapse, providing investors with opportunities to profit.

With all of this being said, the main message is that, given time, markets will recover from financial collapses and downturns, driven by the innovation and resilience of investors and businesses, which are fundamental to capitalism.

However, to protect yourself and possibly profit from a potential market bubble "pop"?

The question of how to protect yourself and profit during an economic downturn is a challenging one, especially in the context of a possible market bubble, but I will do my best to answer. To avoid losing money during a potential market bubble, I recommend that management mitigate risk by diversifying its holdings across various asset classes. What this means is for investors to hold securities in multiple sectors of the market (Examples: tech, manufacturing, retail, defense, banking, etc) and across various types of assets+commodities (Examples: bonds, cash, gold, cattle, wheat) so in case of an economic downturn such as a bubble "pop," your portfolio will likely take less of a hit overall then it would if it was concentrated in one industry that might have been heavily affected by the downturn. Combined with the strategy of diversification comes the strategy of buying quality stocks that also maintain liquidity. What this means is that investors should buy stocks with healthy balance sheets, with net positive profits and positive cash flow, and that can be sold easily in case of a downturn (liquidity). These measures will provide investors with safety nets to protect them from losing money during downturns. To note, this strategy also incorporates measuring risk, which can be done utilizing the efficient frontier theory, which entails balancing optimal returns with risk measured in standard deviations. This will theoretically allow investors to make returns.

Now, to discuss making money. This will be tougher than ever during economic downturns and during times of bubble "pops" and expansions. However, I end up going about it by riding the momentum with strict and apparent exit strategies. This can be achieved using the efficient frontier theory(shown above in the chart), which involves balancing optimal returns with risk measured in standard deviations. This will theoretically allow investors to make a profit off returns while being conscious of risk at the same time, in order to make money during times of bubbles. Another strategy to capitalize during times of bubble expansion and "pops" would entail buying when momentum is high and selling when momentum is low. Notably, this requires careful monitoring of industries and markets to track the overall market momentum. This would lead to short-term investors netting short-term gains from changes in market sentiment. An essential thing to mention is that these strategies are for short-term investors (traders). I am a long-term investor with a flexible timeframe and limited cash needs. That is why I would recommend investors, no matter if they have short-term or long-term focuses, to weather out times of uncertainty without buying or selling during the uptick in markets, and then, when an economic downturn ensues, buy some low-risk stocks (established companies) so when markets go up, you can make a profit.

Comments

Post a Comment